- The number of new and returning equity release customers reached a new quarterly high of 23,395 between January and March this year

- A total of 150,653 new and existing customers have been active during the pandemic, starting from Q2 2020, compared with 171,586 in the previous two years.

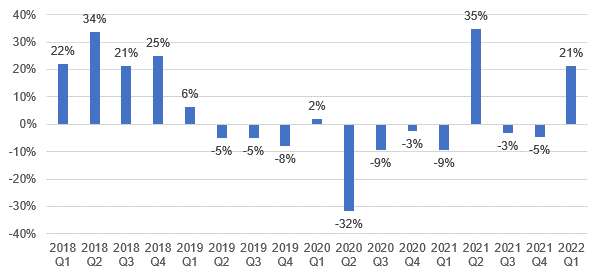

- Annual growth in the number of new plans agreed recovered to 21% in Q1 from -9% a year earlier

- Total quarterly lending reached £1.53bn between January and March, up from £1.34bn in Q4 2021

- The average new loan size grew 6% year-on-year, matching the latest inflation figure¹ and surpassed by the 11% annual UK house price rise which added £27,000 to the average home²

David Burrowes, Chair of the Equity Release Council, comments:

“The popularity of equity release so far this year is the natural result of modern products offering greater flexibility and a property market where growth has far outstripped inflation, alongside an ageing population.

“After two years where customer numbers have been subdued by the pandemic, realising gains from rising house prices can make a major difference to people’s quality of life.

“Not only are more people considering equity release, but they are doing so for many different reasons and helping old and young alike to fund everyday costs and major life events.

“Innovation has made equity release products more adaptable to customers’ changing circumstances. Our standards mean lifetime mortgages remain the most secure type of retirement home finance, with customers protected from interest rate rises, repossession and passing on debt due to negative equity.

“However, it remains vital that decisions are carefully considered through both a long-term and short-term lens, with family input wherever possible and with financial and legal advice in every instance.”

- Key statistics for Q1 2022

Overall activity

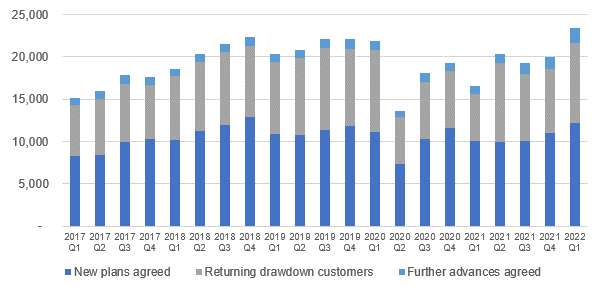

- A total of 23,395 new and returning customers over the age of 55 used equity release products to access money from the value of their homes between January and March. This was up from 19,975 in Q4 2021 and 16,527 in Q1 2021 when pandemic restrictions were still in place. [see graph 1]

- It is the first time that total customer numbers have exceeded 23,000 in any quarter, with activity having fallen as low as 13,617 at the height of the pandemic in Q2 2022.

- Overall, the two years of pandemic conditions (starting from Q2 2020) have seen 150,653 new and existing customers access property wealth via equity release plans, compared with 171,586 in the previous two years (ending Q1 2020).

- Q1 2022 saw customers unlock £1.53bn of property wealth in total. This was up 14% from £1.34bn in Q4 2021 – previously the busiest quarter on record – and up 34% year-on-year from Q1 2021.

Trends among new customers

- The number of new plans agreed reached 12,174 in Q1 2022, a 21% increase year-on-year from 10,030 in Q1 2021 which was down 9% from the previous year as a result of pandemic conditions [see graph 2]

- March was the busiest month for new plans agreed during Q1, with 4,560 completions. March also saw the introduction of a fifth ‘product standard’ or prerequisite for all plans recognised by the Council, guaranteeing new customers’ right to make penalty-free partial repayments. This has become an increasingly common design feature of modern equity release plans, with existing customers saving almost £100m in future interest costs by using this flexibility during 2021.³

- Drawdown lifetime mortgages remained the most popular option with new customers (54%), while 46% opted for a lump sum lifetime mortgage.

- The average first instalment of a drawdown lifetime mortgage grew 5% (£4,457) annually to £94,215 while the average lump sum lifetime mortgage rose 7% (£8,753) to £131,781. The combined average increase (6%) matches the latest change in the consumer price index (6.2%)¹ with both increases surpassed by the 11% annual rise in UK house prices to February 2022, which added £27,000 to the value of the average home².

Trends among returning customers

- Q1 2022 saw 9,450 existing customers with drawdown lifetime mortgages return to withdraw funds from their agreed reserves. This was up from 7,571 in Q4 2021 and 5,566 in Q1 2021 but remains below the pre-pandemic peak of 9,805 in Q1 2020 with this area of the market having been the most subdued in the last two years.

- Further advances were agreed for 1,771 plans between January and March 2022, as customers sought extensions to existing plans to unlock additional property wealth. This is likely to be influenced by more customers overall having equity release plans and house price gains providing more equity to draw on. Approximately 1% of existing customers took a further advance last year.

- Market data

Graph 1: Equity release customers numbers, by type of customer, Q1 2017 to Q1 2022

Source: Equity Release Council

Graph 2: Annual change in the number of new equity release plans agreed, Q1 2018 to Q1 2022

Source: Equity Release Council

- About the data

The Equity Release Council’s market statistics are compiled from member activity, including all national providers in the equity release market. This latest edition was produced in April 2022 using data from customer activity during the second quarter of the year (January to March). All figures quoted are aggregated for the whole market and do not represent the business of individual member firms.

Equity release products are available to homeowners aged 55+, enabling them to release money from the value of their home following a regulated process of financial advice and independent legal advice to determine whether this is suitable for their individual circumstances and long-term needs. Funds released are typically used for a range of purposes including providing additional retirement income, funding one-off expenses and lifestyle purchases, consolidating debts, meeting homecare costs and gifting a ‘living inheritance’ to family or friends.

For a comprehensive list of members, please visit the Council’s online member directory.

¹ Office for National Statistics, Consumer price inflation [CPIH], March 2022

² Office for National Statistics, UK House Price Index, February 2022

³ Equity Release Council, New product standard launched in refreshed rules and guidance, March 2022

The Equity Release Council is the representative trade body for the UK equity release sector with almost 700 member firms and almost 1,600 individuals registered, including providers, funders, regulated financial advisers, solicitors, surveyors and other professionals.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, over 600,000 homeowners have accessed £40bn of housing wealth via Council members to support their finances.

The Council also works with government, voluntary and public sectors, and regulatory, consumer and professional bodies to inform and influence debate about the use of housing wealth in later life and retirement planning.

For further information, please contact:

Email: Instinctif Partners at [email protected]

Phone: Rosie Cohen, Andy Lane and Barney McCarthy at Instinctif Partners on +44 (0) 207 427 1446