eFront’s latest research finds that recent historically low levels of capital calls from LBO funds could protect them as markets fall into recession

eFront, the leading financial software and solutions provider dedicated to Alternative Investments, has published its latest research on LBO and VC performance during crises: “Private Markets in Downturns: 3 Observations”.

Key findings:

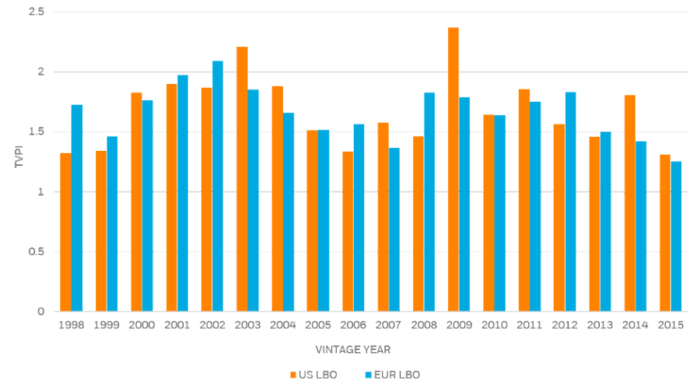

- The record performance of 2003 and 2009 vintage years in the US LBO market, as well as of 2002 and 2008 vintage years in European LBO market, indicate that funds that invest during a recession or in the early stages of recovery generate superior performance.

- Funds that suffered the hardest hit on their NAVs are those with investment periods just prior to downturn. The poorer performance of vintage years 1998-99 and 2005-06 confirms this.

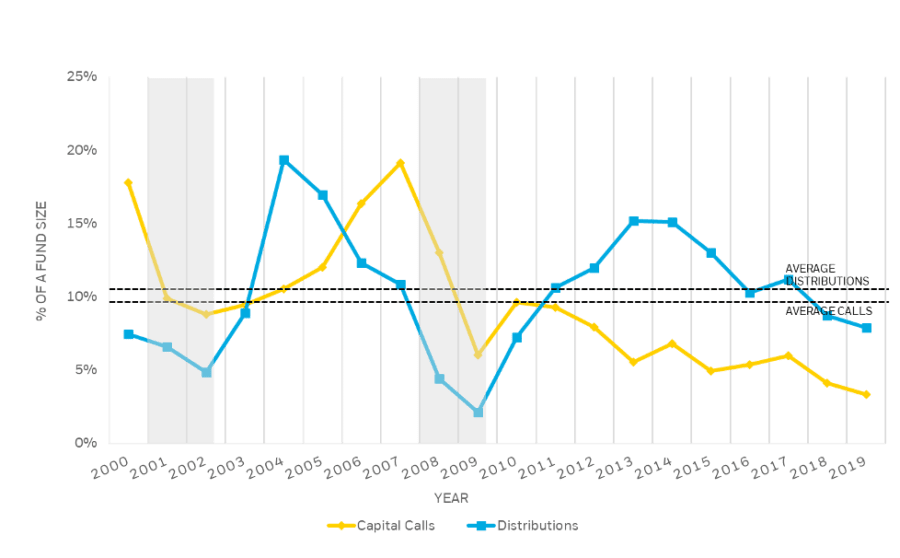

- However, in the years running up to the global financial crisis, the annual level of capital calls was very high, reaching 16.3% in 2006 and 19.1% in 2007, as LBO funds put huge sums of capital to work at the top of the market.

- This is in sharp contrast to recent years, with 2018 funds deploying just 4.1% and 2019 funds investing only 3.3%, indicating that GPs were not rushing to deploy capital in a highly priced market and may therefore not experience the fate of vintage years 2005-06.

- During the early 2000s recession and global financial crisis, meanwhile, capital calls never dropped below 5%, indicating that private equity funds are able to keep investing even during the depths of an economic downturn.

Analysis

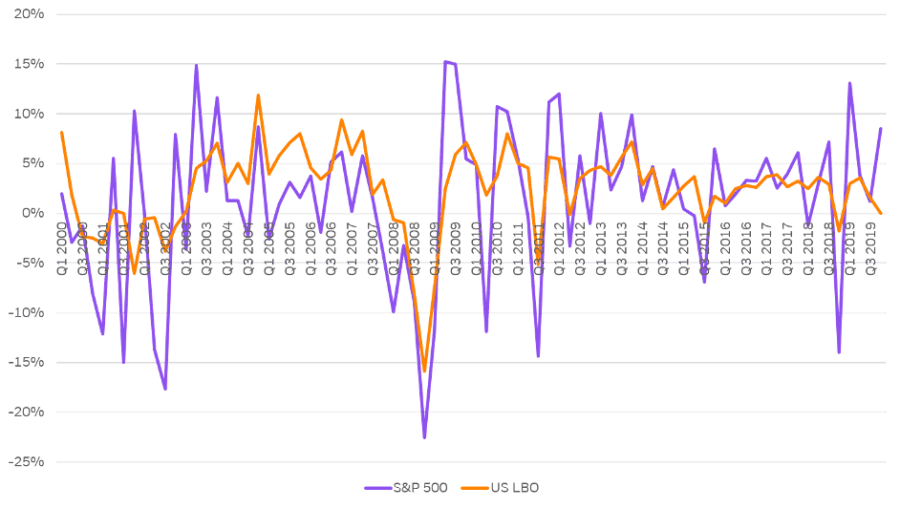

Our previous research provides evidence for private equity fund performance being significantly positively correlated with public equities. It reports the coefficient of correlation between US buyout market quarterly returns with S&P 500 of 0.64 for the period between 1992 and 2018 (Figure 1).

Private equity NAVs under-react to the evolution of market indexes of listed assets, both in terms of downside and during the subsequent recovery periods, for a number of reasons. First, the composition of the indexes and the portfolio of funds differs significantly. Second, fund managers tend to react faster, thanks to advanced and early KPIs, but also strong governance frameworks and through supporting portfolio companies during downturns. Third, listed markets tend to over-react to events and downturns, before reverting to the average.

Figure 1: Historical quarterly returns of S&P500 and the NAV of US LBO funds

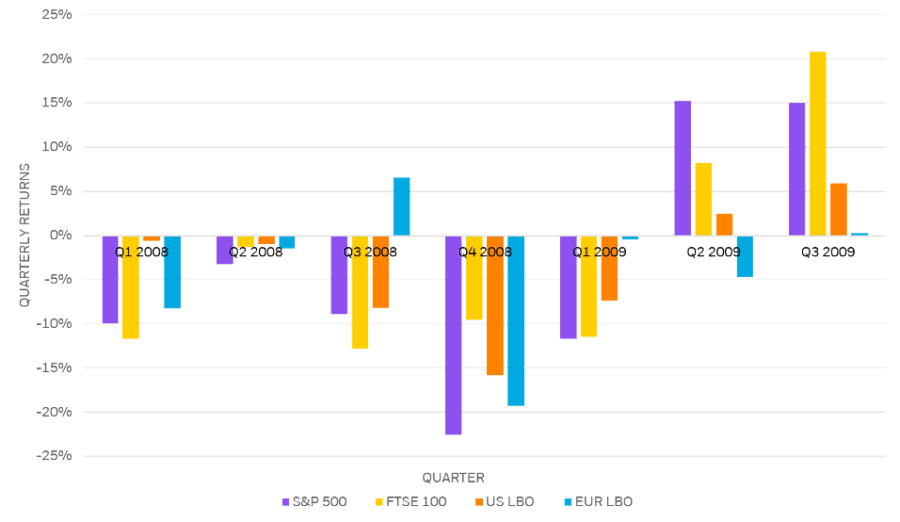

A close look at the private market returns shows that US and European LBO funds exhibited strong resilience in the early 2000s, with US LBO market declining by less than 13%. Figure 2 illustrates the under-reaction of the US and European NAVs relative to the evolution of public indexes during the global financial crisis. The S&P 500 suffered a quarterly drop of 23% in Q4 2008, followed by another massive loss in value in the subsequent quarter. However, LBO funds showed more stable evolution by recording lower losses during those quarters, but also by exhibiting relatively lower recovery rates during Q2 and Q3 in 2009, relative to S&P 500.

Figure 2: Quarterly evolution of major indexes and NAVS of US and LBO funds during GFR

The European private equity market showed more volatility than US funds, as its LBO funds experienced an actual NAV appreciation in Q3 2008 but corrected sharply in the next quarter. The correlation between FTSE 100 and the LBO market was at the very low level of 0.16. Overall, this gives a more positive hue for private equity funds as economies globally enter potentially very deep recessions.

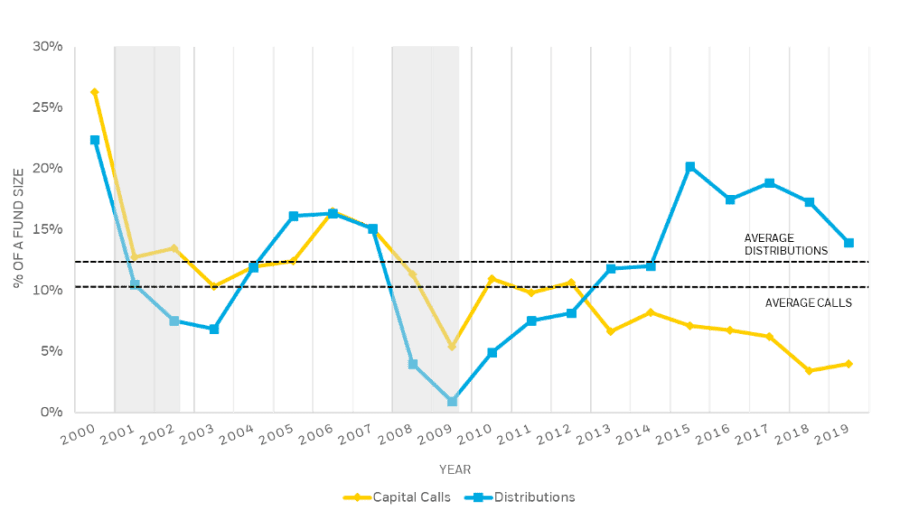

A second factor that could significantly insulate LBO funds from the wider economic malaise is the dynamics of capital calls and distributions in recent years. In the run up to the global financial crisis, capital calls spiked, reaching well over 15% of total fund size in both the US and European buyout markets in 2006-07, indicating that funds were putting enormous sums of capital to work at the very peak of the market.

This time, the pattern is very different, with capital calls falling below 5% in both markets in 2018-19. This may indicate that funds of recent vintage years have not been rushing to deploy capital early in a highly priced market, potentially limiting the damage caused to portfolios and also meaning that investors have large pools of dry powder available to make new acquisitions.

Figure 3 shows the annual capital calls and distributions of US LBO funds. Towards the end of the downturns, LBO fund managers started snapping up good investment opportunities in difficult times, at attractive valuations, which gave an impulse to increase drawdowns.

Figure 3: Annual calls and distributions of US LBO funds

Figure 4 shows the annual capital calls and distributions of European LBO funds. The upward recovery trend over the years that followed both recessions in the LBO markets can be attributed to expansionary macro policies that were enacted in both US and European countries. Low interest rates gave rise to increasing company valuations and a stronger exit environment.

Figure 4: Annual calls and distributions of European LBO funds

Finally, there also appears to be a strong relationship between the maturity of funds during downturns and their subsequent performance. The record performance of 2003 and 2009 vintage years in the US LBO market, as well as of 2002 and 2008 vintage years in European LBO market, indicates that funds that invest in advance of a recovery, or in its earlier stages, generate superior performance (Figure 5). This can be explained by lower entry valuations and by the benefits of expansionary macro policies that promote economic growth, and should help to boost the performance of funds of vintage years 2020-21.

Figure 5: Historical performance of US and European LBO funds of different vintage years

Given the unambiguous nature of this downturn, driven by deliberate economic shutdowns, it may be that GP write-downs this June and September will be more decisive than in other downturns. On the other hand, a different industry composition, more inclined toward pharmaceutical and IT companies may be a cause for private market under-reaction. Unlike the previous two downturns, however, private market managers had been radically reducing their deployment of capital in the run up to this recession, while raising unprecedented amounts of capital. Whether this was a result of luck, judgement or intuition, the industry appears exceptionally well placed to invest into any recovery. History suggests that those who start do so quickly, will reap the most benefit.